Global Capital Markets

.What they are. How they work.

How they are interconnected, the different types of financial instruments traded in them, and their impact on the global economy.

.Useful information in just one-minute-read.

Global capital markets are the financial markets where companies and governments can raise funds from investors worldwide. They are interconnected and allow the flow of capital across the world. In this blog post, we will provide an overview of the global capital markets, including how they are interconnected, the different types of financial instruments traded in them, and their impact on the global economy.

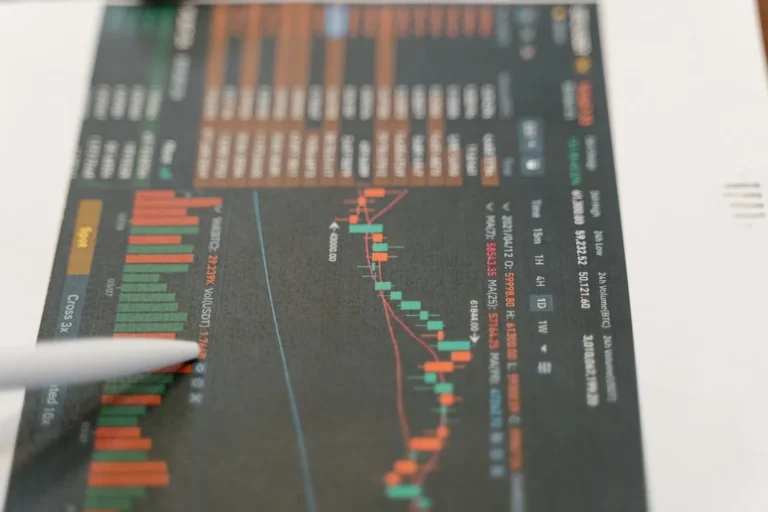

The global capital markets are interconnected through various financial instruments such as stocks, bonds, currencies, and commodities. Investors from different countries buy and sell these instruments, creating an international flow of capital. The interconnected nature of global capital markets means that any event in one country can have a significant impact on other countries and their economies.

There are different types of financial instruments traded in the global capital markets. Stocks, also known as equities, represent ownership in a company and give investors a share in the company’s profits. Bonds, on the other hand, are debt instruments that represent a loan made by investors to the issuer, which could be a company or a government. Currencies, commodities, and derivatives are other types of financial instruments traded in the global capital markets.

The global capital markets have a significant impact on the global economy. They provide companies and governments with the funds they need to finance their operations and projects, which in turn stimulates economic growth. These markets also provide investors with opportunities to diversify their portfolios and earn higher returns.

However, the global capital markets are not immune to risks. Economic and political events in one country can have ripple effects on other countries and their economies. For instance, a financial crisis in one country can trigger a global recession, affecting investors worldwide.

In conclusion, the global capital markets are an essential part of the global economy. Understanding how they work and the different types of financial instruments traded in them can help investors make informed investment decisions. However, it is crucial to keep in mind the risks associated with investing in global capital markets and to seek the advice of financial professionals before making any investment decisions.